Some Ideas on P3 Accounting Llc You Need To Know

Wiki Article

P3 Accounting Llc for Beginners

Table of ContentsFascination About P3 Accounting LlcThe 20-Second Trick For P3 Accounting LlcThe Definitive Guide for P3 Accounting LlcP3 Accounting Llc Fundamentals ExplainedThings about P3 Accounting LlcSome Known Factual Statements About P3 Accounting Llc

and operates in 143 countries. In 2002, "Big Eight" firm Arthur Andersen was uncovered to have actually shredded paperwork in an effort to conceal Enron's falsified economic numbers. One of the largest and most trustworthy firms at the time, it eventually broke down due to the scandal. 2021 Yearly Profits in U.S.

While incomes change with time and economic situations, below are some average annual U.S.

com Tax AnalystTax obligation Expert71,493 Accountant: Accounting professional54,774 Certified Public Licensed: $84,895 Auditor: $66,307 Business AnalystService Expert93,808 Cybersecurity analyst: Expert96,000 Source:. Com Tax obligation Consultant: $60,000 Accounting professional: $30,000 Audit Manager: $117,622 Auditor: $104,772 Financial Expert: $69,053 IT Safety and security Professional: $120,656 Resource:.

The Only Guide to P3 Accounting Llc

The busy period generally implies lengthy hours of bookkeeping or tax conformity work to satisfy reporting due dates for clients. Big 4 employees often work a lot longer hours throughout the hectic period, often doubling the hours worked throughout the off period. The active period typically begins at the beginning of the calendar year with many records and returns due between January and April.

The Big Four describes the four largest bookkeeping firms in the U.S. While they utilize a terrific number of people, these companies additionally have their critics. Largely, people criticize them for not asking customers the hard questions needed to uncover fraudulence.

See This Report on P3 Accounting Llc

in, Dinero coverings its customers with a large range of accounting solutions, a simple platform, accessibility to in-house professionals, and a specialized customer support group, making it our selection as the finest overall accounting company. Pros Comprehensive selection of solutions Simple control panel Wonderful customer support Mobile app Cons Base bundle on the pricey end of the range Absence of sophisticated attributes such as time-tracking and job supervisor Given that its beginning in 2009, in, Dinero has actually been improving its offering of an all-in-one accounting service for local business.

In, Dinero checks all packages, making it our choice as the best overall accounting firm for small companies. While in, Dinero's base strategy may be a little costlier than other companies, its all-in-one accounting solutions still will certainly conserve fledgling businesses money and time. For $300 a month, the Vital strategy is stacked loaded with features consisting of easy invoicing, P&L and annual report development, accounts payable and receivable monitoring and reporting, regular monthly reconciliations, employee compensations, monetary reporting, and record administration.

The Necessary strategy is developed for start-ups and smaller sized services that make use of money basis accountancy. If you need amassing basis bookkeeping, you will need to step up to its Development plan. At $900 each month, the Growth strategy is designed for more established small and medium-sized services. It's costlier, yet it adds some considerable functions, such as accrual audit and normal controller support.

The 6-Minute Rule for P3 Accounting Llc

Note For extra fees, in, Dinero provides tax assistance for submitting state and government taxes for present or previous years. You likewise can add a fractional CFO to assist with economic estimates, cash monitoring, organization analytics, and budgeting. Plus, if you have actually been neglecting your books, in, Dinero supplies catch-up bookkeeping.In enhancement to its real-time dashboard, which provides self-support features, clients can take advantage of in, Dinero's support team by means of phone, e-mail, or live conversation. On the disadvantage, if you aren't utilizing Gusto, Red stripe, Expensify, Netsuite, or Tri, Net, you'll need to make use of in, Dinero's software application, which is really powerful, but it's not mobile if you ever before choose to switch firms.

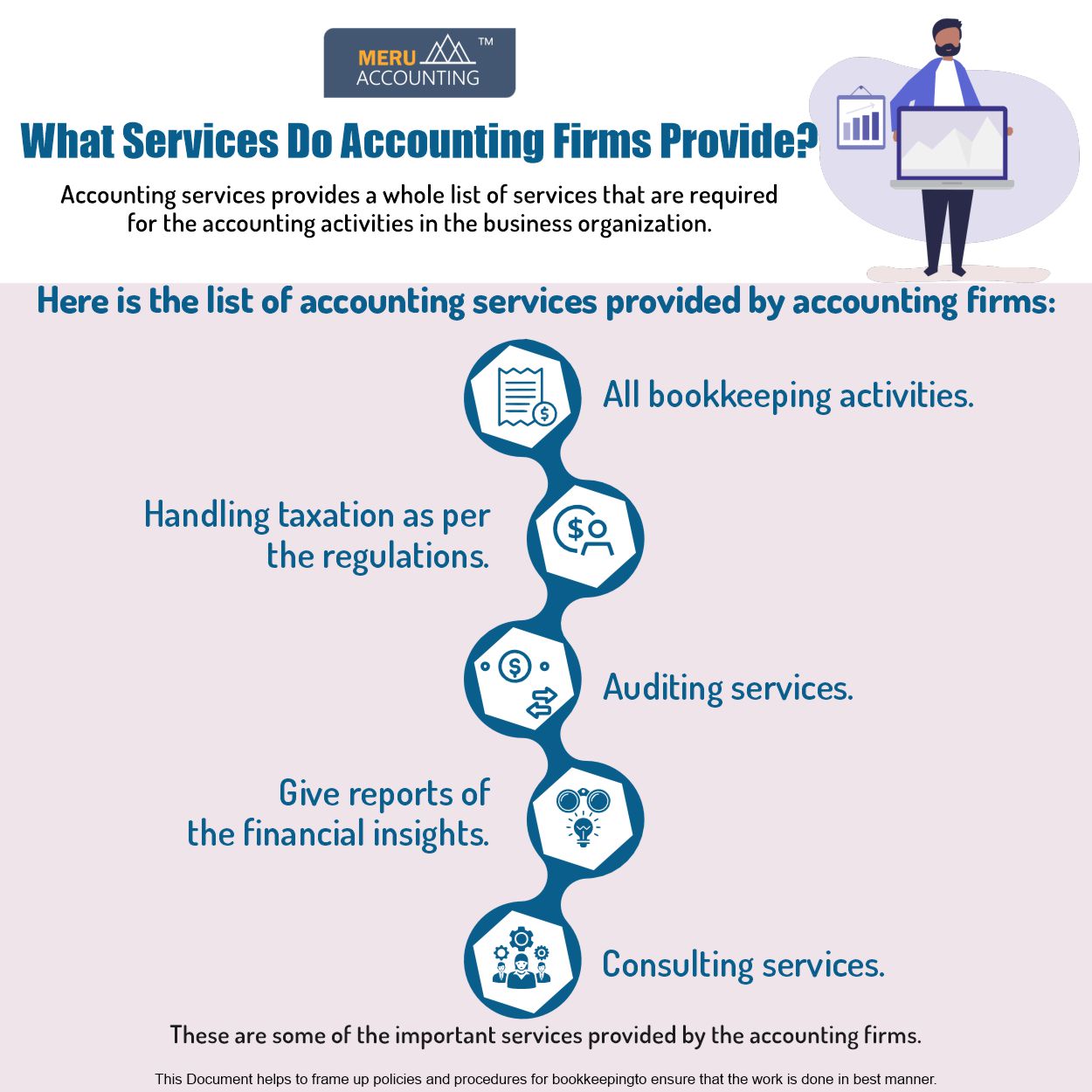

To many little and expanding companies, bookkeeping and accounting are considered as something of a "required click to read evil". Every person understands that you can't do without these vital solutions, but nobody really desires to invest all their time maintaining the books. If you're the owner of business, your time can certainly be much better made use of in various other tasks, and it doesn't constantly make good sense to work with an accountant or an accountant and take on the added prices of income, benefits, office, and extra.

The Basic Principles Of P3 Accounting Llc

Digital audit, in instance you're not accustomed to the term, refers to accounting work that is done outside of your business's offices. It generally capitalizes on contemporary cloud technologies, therefore, is likewise in some cases described as "cloud bookkeeping". Whatever you call it, it's a superb way to enjoy the benefits of having a full-time, full-service bookkeeping division, yet without the expenses and obligations of handling that department in-house.Your virtual accounting professional will take complete responsibility for all of the routine accounting job that you need to do on an ongoing basis. The team can absolutely take care of all accounts payable and receivable, along with cash money account ledgers (https://issuu.com/p3accounting). This consists of handling of billings for your clients and the repayments you get from them

No 2 services are specifically the very same, so cookie-cutter audit remedies don't really make feeling. Your online audit company will certainly do an initial assessment to understand your company version, and to discover your existing systems and processes. After doing a detailed evaluation, they'll propose a remedy to fit your certain demands and enhance your procedures.

Report this wiki page